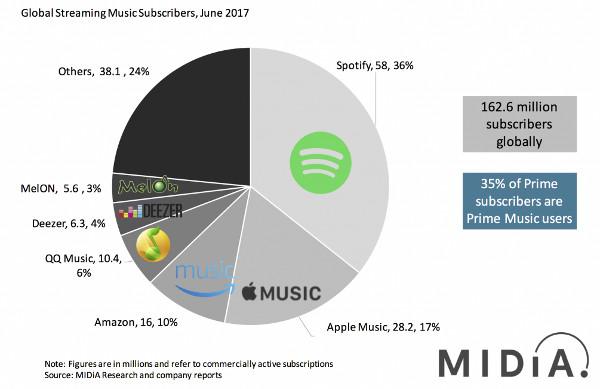

Amazon Now 3rd Largest Music Streaming Service

London-based Midia Research reports that Amazon Music is now the world's third-largest music subscription service with around 18 million subscribers as of mid-2017 — 16 percent of a market with more than 162 million subscribers — making it a contender behind Spotify and Apple Music, which command respective market shares of 58 percent and 28 percent.

From the Midia report:

Back in the days when online music meant online CD sales, Amazon was the king. Then, along came Apple with iTunes music store and Amazon saw the throne snatched from its hands. No sooner had Apple started to enjoy its reign that Spotify came along to usurp the throne. Now streaming’s game of thrones is experiencing another plot twist, with a resurgent Amazon battling for supremacy through an ambitious streaming music strategy that owes a considerable debt of gratitude to Apple for strategic inspiration. Throughout the emergence of the streaming market, Amazon has played the role of a dark horse, skulking on the side lines. Now, Amazon is out of the shadows and revealing its potential to be one of streaming’s biggest players.• Delivering the numbers: Total music subscribers globally grew to 162.6 million in June 2017, up 30 million from 132.6 million at the end of 2016.* Amazon is now the third largest streaming music service globally with 16 million subscribers as of June 2016, across Amazon Prime Music and Music Unlimited. The nearest challenger is QQ Music in fourth place with over 10 million subscribers, but Amazon has its eyes set firmly upwards, and Apple Music is in its sights. Meanwhile, Spotify remains on a different lap of the streaming race compared to the competitors, largely retaining market share regardless of the competition, as Amazon’s role is transformed. Since June 2014 Amazon accelerated from 14th position to third place in the global streaming rankings.

• Commercial strategy: Of the top six streaming subscription services only Spotify is truly independent (Deezer is in principle, but is majority owned by Access Industry which also owns, among other things, Warner Music). What this means is that Spotify, and to a lesser degree Deezer, are the only ones that live or die by commercial sustainability. Apple measures success by how it enriches the Apple ecosystem, and Amazon by how it enriches the Prime ecosystem. In fact, Amazon is taking Apple’s 2000s iTunes / iPod strategy and applying it to household devices (Echo, Fire TV) for Prime. Amazon is pivoting much of its business to services-based revenue streams (eg AWS, Video) and its streaming music strategy is part of that, building a content play for when media sales die. Amazon is investing in its long-term future.

• Audience strategy: More than two-thirds of music subscribers are aged under 40, with the majority of them aged 25-34. Everyone is chasing the same, narrow band of younger, mobile centric, engaged music fans. Everyone, except Amazon that is. Amazon’s strategy is to compete around everyone else, aiming for the larger addressable base of mainstream, older households. Unfortunately, many of these users are unlikely to want to pay $9.99 a month just for music, and most don’t spend much time listening to music on their phones. This is why Alexa, Echo and the Prime ecosystem are Amazon’s secret weapons, delivering free-at-point-of-access, speaker-led music experiences.

If you subscribe to Amazon Music, how’s it stack up against other music services?

- Log in or register to post comments